Total Loss Assessment (TLA) is a meticulous process that insurance companies and collision centers use to evaluate vehicle damage beyond cosmetic repairs. Employing advanced diagnostic tools, TLA identifies electronic issues and structural integrity, ensuring no component is overlooked. This method determines 'total loss' by balancing repair cost and effort against the vehicle's value, guiding informed decisions for paint repair, bodywork restoration, and insurance claims handling. TLA streamlines operations, enhances customer satisfaction, and contributes to risk management in the automotive sector.

In the intricate landscape of insurance, risk management, and business continuity, Total Loss Assessment (TLA) stands as a robust strategy for gauging potential setbacks. This comprehensive process identifies and quantifies losses, enabling proactive measures to mitigate future risks. From natural disasters to cyberattacks, TLA is pivotal in diverse scenarios, ensuring businesses are prepared. By understanding the core concepts, implementing structured procedures, and optimising outcomes, organisations can effectively navigate uncertainties and foster resilience. Explore these facets to harness the power of TLA for robust risk management.

- Understanding Total Loss Assessment: Key Concepts and Definition

- – What is total loss assessment?

- – Importance in insurance, risk management, and business continuity.

Understanding Total Loss Assessment: Key Concepts and Definition

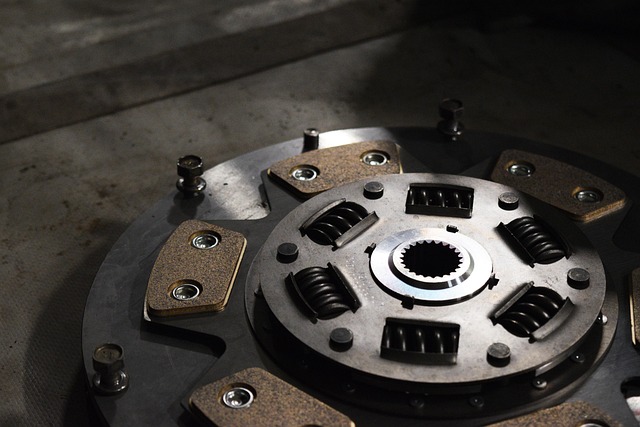

Total Loss Assessment (TLA) is a crucial process in the automotive industry, particularly for insurance companies and collision centers. It involves evaluating and determining the overall damage to a vehicle, often beyond simple cosmetic repairs. When a vehicle incurs extensive damage, such as in severe accidents or natural disasters, TLA becomes essential in accurately estimating the cost of complete restoration or replacement.

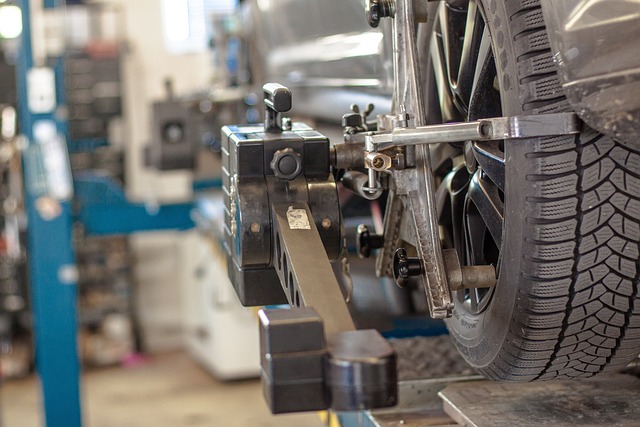

The key concepts behind TLA focus on understanding the vehicle’s pre-accident condition, assessing every aspect of the bodywork, and considering potential hidden damage. It goes beyond visual inspection by incorporating advanced diagnostic tools to scan for electronic issues and structural integrity. This comprehensive approach ensures that no component is overlooked during the repair process. By accurately defining ‘total loss,’ TLA guides decision-making for vehicle paint repair, ensuring that only authorized and necessary repairs are conducted, ultimately optimizing vehicle repair services and bodywork restoration efforts.

– What is total loss assessment?

Total loss assessment refers to a comprehensive evaluation process used primarily in the automotive industry to determine the feasibility of repairing a damaged vehicle. When a car incurs significant damage, either from an accident or other mishaps, this method is employed to analyse the cost and effort required for repairs versus the vehicle’s overall value. By conducting a total loss assessment, auto body services can offer accurate estimates for replacement or total reconstruction, ensuring fair compensation for the owner.

This procedure involves meticulous inspection of the vehicle’s exterior and interior, including structural integrity checks, paint analysis, and assessment of hidden damage like dent repair needs. In many cases, auto dent repair specialists play a crucial role in this process by identifying and repairing subtle yet critical dents and scratches that could impact the car’s overall appearance and value. The outcome of a total loss assessment guides insurance claims, helping both policyholders and insurers make informed decisions regarding repairs or replacements, thereby streamlining post-damage management for all involved parties, including those seeking car scratch repair services.

– Importance in insurance, risk management, and business continuity.

Total Loss Assessment (TLA) plays a pivotal role in ensuring effective insurance claims processing, risk management strategies, and business continuity planning across various industries. In the realm of automotive repairs, for instance, a TLA is crucial when dealing with extensively damaged vehicles. It involves a comprehensive evaluation of the vehicle’s condition, considering both structural integrity and economic feasibility of repair. This process helps insurance providers and policyholders make informed decisions about whether to repair or replace the affected asset.

For collision centers and body shop services, implementing robust TLA procedures can streamline operations and enhance customer satisfaction. By accurately assessing total losses, businesses can efficiently manage resources, prioritize work orders, and provide transparent communication regarding expected turnaround times and costs. Moreover, TLA aids in risk management by identifying potential hazards within the auto maintenance sector, enabling proactive measures to mitigate future risks and ensure business resilience.

Total loss assessment is a vital process for businesses and insurers to mitigate risks and ensure resilience. By understanding and applying these procedures effectively, organizations can make informed decisions, minimize financial impacts, and enhance overall business continuity. This strategic approach allows for a comprehensive evaluation of potential losses, enabling proactive measures to safeguard assets and future-proof operations. Embracing total loss assessment is key to navigating the complexities of modern risk management.